There’s nothing quite like the thrill of carving down pristine slopes or sipping hot chocolate by a cosy fire after a day in the snow. But while winter holidays promise adventure and unforgettable memories, they also come with risks – especially if you hit the slopes without travel insurance.

A Broken Leg is now the most common ski injury

Surprisingly, one in ten winter holidaymakers jet off without insurance, despite the staggering costs of medical care abroad. On average, a sports injury can set travellers back £2,190, with some cases climbing far higher. According to recent data from insurer Aviva, the most common slope-side injury is a broken leg, costing on average, an eye-watering £6,165 to treat. In fact, broken legs have overtaken dislocations as the most frequent mishap for winter sports enthusiasts, knocking shoulders out of the top spot from last year. Other costly injuries include fractured ribs (£7,827), collarbone fractures (£3,789), and broken wrists (£2,422).

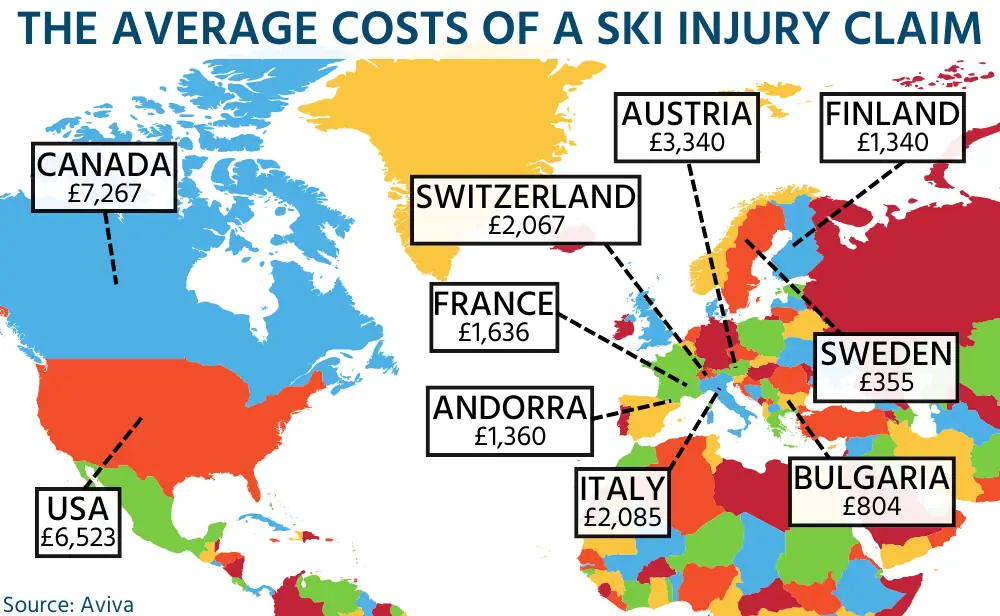

The price of treatment varies dramatically depending on where you are. Canada has now overtaken the U.S. as the priciest country for winter sports injuries, with an average bill of £7,267.

Don’t Let an Injury Ruin Your Holiday or your finances!

Suzanne Caine, a travel claims expert at Aviva, warns: “Winter sports holidays and the après-ski scene can be quite the trip, but they often come with more risks compared to your typical beach getaway. That’s why it’s crucial to review your policy documents and ensure you have the appropriate cover for your destination and planned activities.”

Shockingly, a census-wide survey commissioned by Aviva found that one in eleven travellers (9%) never take out travel insurance at all. Even for those who do, not all policies are created equal. Some insurers cover off-piste skiing, but only with a qualified guide, while others limit coverage strictly to marked runs. If you’re planning a ski holiday, be sure to check the fine print and declare any pre-existing medical conditions, as failing to do so could render your policy invalid.

Getting the Best Value on Travel Insurance

To get the most bang for your buck, an annual multi-trip policy often offers better value than a single-trip cover, especially if you’re planning multiple adventures throughout the year. And while comparison sites are a great way to find competitive rates, those with pre-existing medical conditions may struggle to secure affordable coverage this way. If that’s the case, the British Insurance Brokers Association offers a ‘find a broker’ tool, or you can call 0370 950 1790 for expert advice.

Caine adds: “If you need hospital treatment or an early flight home, costs can soar into the tens or even hundreds of thousands. By securing travel insurance as soon as you book your holiday, you safeguard yourself and your belongings, providing peace of mind as your trip approaches.”

So before you pack your ski boots and hit the slopes, take a moment to ensure you’re properly covered. While fresh powder and crisp mountain air make for the perfect winter escape, the last thing you want is a hefty medical bill bringing your holiday to an abrupt halt!

Don’t forget, if you have booked an ATOL bonded skiing holiday, like the ones we feature on the Skiline.co.uk site, most of these travel companies make it a condition of travel, that you obtain adequate travel insurance before you travel.

Ski Line recommends that as soon as you book and pay for your ski holiday, your next job is to book travel insurance, then you will be covered for any insured risk, such as illness meaning you need to cancel your holiday.

Skiing Without Travel Insurance? Are You Mad?: A Summary

Ski holidays offer adventure and excitement, but they also come with risks, especially for those without travel insurance. A broken leg has become the most common ski injury, costing an average of £6,165 to treat, with other injuries like fractured ribs and collarbones also racking up hefty medical bills. Canada now surpasses the U.S. as the most expensive country for winter sports injuries, with treatment averaging £7,267. Shockingly, one in ten travellers heads to the slopes uninsured, potentially facing thousands in unexpected costs. Experts emphasize the importance of securing comprehensive travel insurance, reviewing policy details, and booking coverage as soon as a trip is confirmed to avoid financial setbacks in case of injury or trip cancellations.

Chat with our experts

For tips and advice on booking your next ski holiday, call our expert sales team on:

020 8313 3999 All Ski Deals

All Ski Deals